Double declining balance method calculator

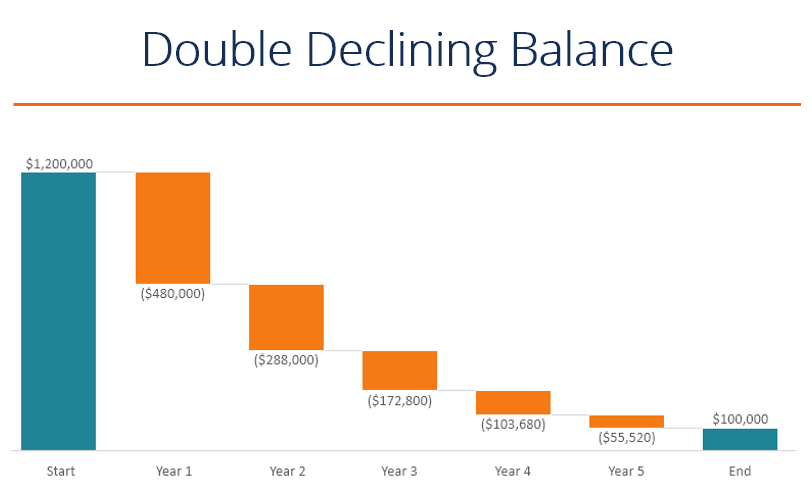

The fixed-declining balance method computes depreciation at a fixed rate. The double declining balance depreciation method shifts a companys tax liability to later years when the bulk of the depreciation has been written off.

Depreciation Formula Calculate Depreciation Expense

First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate.

. Formula for Double Declining Balance Depreciation. The following calculator is for depreciation calculation in accounting. If you are using the double declining.

Because of this it more accurately reflects the true value of. Formula for Double Declining Balance Method. The company will have.

Double Declining Balance Method. Determine the initial cost of the asset at the time of purchase. The double declining balance method is.

If we want to calculate the basic depreciation rate we can apply two formats. DB uses the following formulas to. Then multiply that number by 2 and that is your Double.

If the initial cost of the. Double Declining Balance Method formula 2 Book Value of. The fixed declining balance calculation is based on the Excel function DB.

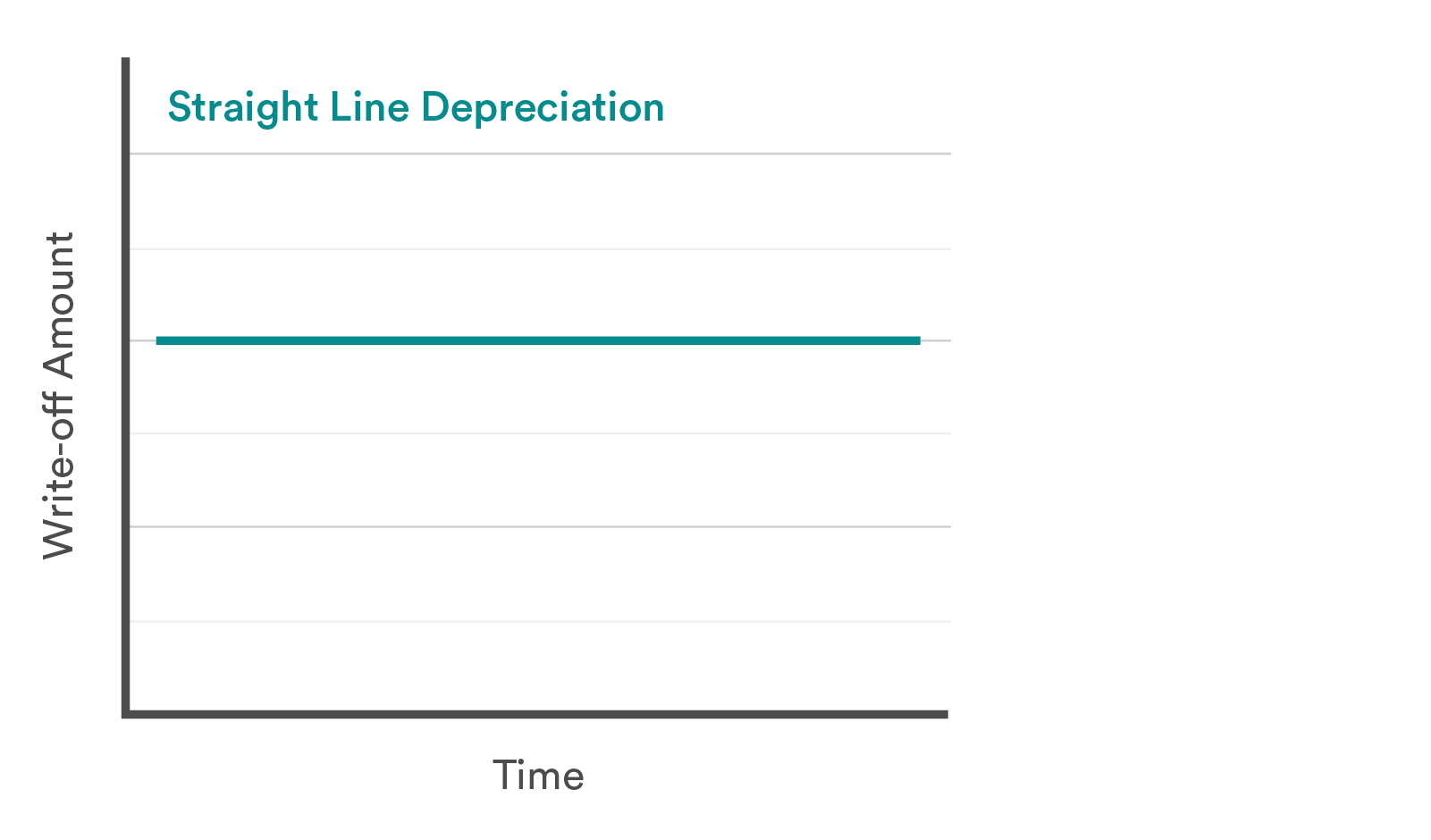

The double-declining balance method accelerates the depreciation taken at the beginning of an assets useful life. A decrease in the asset values is called as depreciation. If the useful life of the object is L years then assume that the annual percent decrease in the objects value is 2L.

Multiply the result by. Divide the basic annual write-off by the assets cost. This type of calculation is allowed under MACRS.

A method of allowing higher deductions depreciation in starting or earlier years is called as the. Calculate depreciation of an asset using variable declining balance method and create a depreciation schedule. There are several steps to calculating a double-declining balance using the following process.

How to Calculate using Calculator. Jan 6 2022 6 min read. It takes the straight line declining balance or sum of the year digits method.

The formula for depreciation under the double-declining method is as follows. This double-declining depreciation calculator will provide you with the calculation of depreciation for the asset with a useful life of five years.

Practical Of Straight Line Depreciation In Excel 2020 Youtube

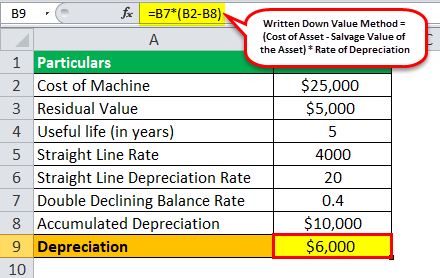

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Deprecitiation Formula Examples

Double Declining Depreciation Efinancemanagement

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Depreciation Formula Examples With Excel Template

How To Use The Excel Db Function Exceljet

Accumulated Depreciation Definition Formula Calculation

Double Declining Balance A Simple Depreciation Guide Bench Accounting

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Depreciation Daily Business

Straight Line Depreciation Formula And Calculator

Double Declining Balance Depreciation Examples Guide

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator